KEY POINTS TO REMEMBER

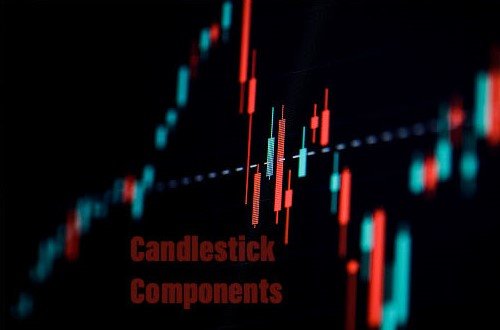

Candlestick charts are used by traders to determine possible price movements based on past patterns.

Candlesticks are useful when trading because they display four price levels (open, close, high and low) for the entire period specified by the trader.

Many algorithms rely on the same price information shown in candlestick charts.