TRADE ORDER

What are trade orders?

Trade orders refer to the different types of orders that can be placed on exchanges for financial assets, such as stocks or futures. The order-driven style of trading mechanisms matches buyers and sellers who have matching order criteria. with a purchase price corresponding to a seller’s sale price will result in an executed trade.

The different types of trade orders allow the trader to maximize the versatility and specificity of his transactions.

The most common types are:

- Market order

- Limit order

- Stoploss order

Trade order: Market order

The market order is the most common and simplest of all trade orders. A market order simply executes the order desired by the volume trader at the best available price. This provides the trader with the most liquidity but the least control over prices.

For example, a market buy order for 5 shares of Company A will buy 5 shares at the lowest asking price currently in the order book.

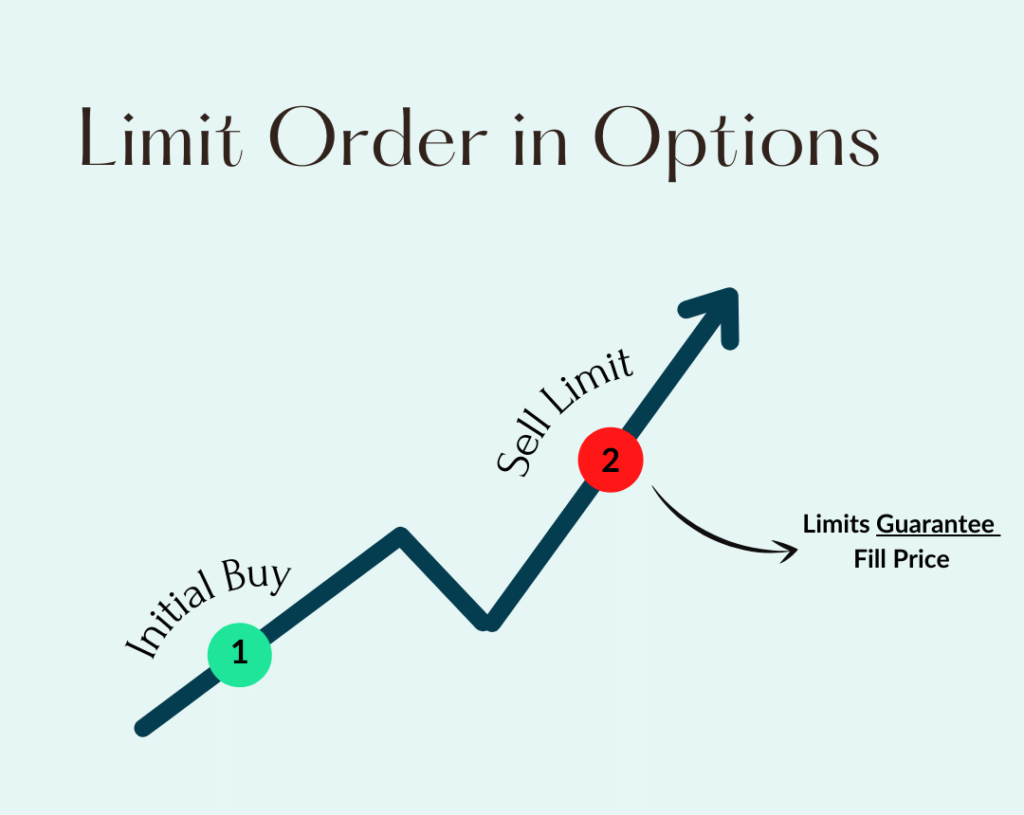

Trade orders: limit orders

The limit order is more complex than the market order. Create a new order in the backlog, often at a “lower” point than the best prices available on either side. This sets the ideal price at which the trader wishes to enter the market. This gives the trader more control over prices but less liquidity. Liquidity is only provided when a counterparty is willing to respect that trader’s price.

The “market” for all limit orders in an order book is the best available price. This means that the lowest selling price (ask) and the highest buying price (bid) is the market. Prices that are worse than these prices (higher demand, lower supply) are called behind the market. New orders above these prices are called into the market. New orders significantly above these prices are marketable.

Trade orders: stop loss orders

Stop-loss orders work the exact opposite of limit orders. A stop-loss order is intended to provide a trader with maximum control if the market moves in the opposite direction from that desired by the trader. This type of order is intended to minimize losses, instead of maximizing profits under the limit order strategy. A stop-loss order is typically placed as a potential exit order to close an existing trade position, but it can also be used to enter the market if the price hits a specified level.

Advanced Trading Orders

It is interesting to note that trading orders can be combined to form complex trading strategies. These are also used in conjunction with options to buy/sell stocks.