Spot price

What is the spot price?

A spot price is the current market price of a commodity, financial product, or derivative. An investor or trader can buy or sell a certain asset or security with immediate delivery at the same price. To be safe, a buyer must pay the spot price right away and the seller must deliver the stock at that time. A spot price is defined by the number of buyers and sellers interested in trading that stock, commonly referred to as depth.

There is no mathematical formula for the spot price. This is more of an economic concept than a mathematical part. At any time, the forces of demand and the offer play a vital role in determining the market price. There will be other factors involved, such as credit risk and market risk, but the price is most often the benchmark for all of this analysis.

Spot Price – Contango and Backwardation

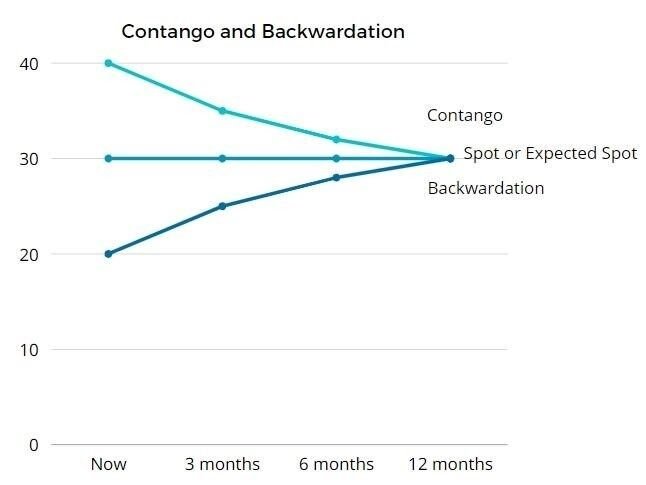

Traders use the spot charge to decide the safety fashion or the economic product. It is performed via way of means of reading the modern-day charge, the destiny charge, and the distinction referred to as a basis. Under regular circumstances, one might anticipate that the destiny price might be extra than the spot charge. It is due to the fact leaving all elements apart is the time cost of money. Simply due to the fact, there may be continually a high-quality chance loose rate that needs to be brought to the spot charge to derive different expenses. When the destiny charge is extra than the spot charge, this state of affairs is called Contango.

On the alternative hand, Backwardation is the state of affairs whilst the destiny charge is much less than the spot charge. Eventually, each of the expenses will converge at the expiry date. The fay in the sort of state of affairs.

Spot Price and Arbitrage

Spot Price for all accounting and calculation purposes is uniform worldwide. However, there may be times when these prices differ. For example, the stock price of Google’s parent company, Alphabet, is different on the NYSE and NASDAQ. unexpectedly, if such a scenario occurs, traders will take full advantage of it. They will stay long where the stock price is low and short where it has a higher price.

As more and more traders try to do this, the price of the two exchanges will converge and eventually match. This situation is called arbitration and these opportunities are pure gold for traders, who would never miss

Spot Price Example

Consider the stock price of Alphabet, Inc., which is quoted at $1,200. This means that a trader interested in this stock must spend $1,200 to own it right now. As soon as the trader does so, he will transfer the Alphabet shares to his account within two days.

Contract details will be recorded and will begin trading at this time. There is also another way for the trader to get these shares by buying the futures contract, which will be different depending on the expiration.

By the contract, a predetermined amount will be transferred to the merchant’s account on the expiration date. When the trader pays a certain amount and gets immediate delivery, he is referring to the spot price. And the latter refers to the future price.

Conclusion

The spot price reflects how things are perceived in the market for that particular security. It can be thoroughly checked and reports the number of buyers and sellers over a given period.

For any commodity, security, or any other type of financial product, the spot price is of paramount importance and a prime number. Any additional price or different calculation must be made taking the current price as a reference. Whether it’s the commodity cost of the stock price or the three-month futures contract, it has to start somewhere and that starting point is called the spot price.

In addition, it can be designed to identify market trends, identify arbitrage opportunities, or any other derived pricing. More often than not, traders around the world analyze bond spot prices, not just current prices, but also those that have been falling for 34 years to identify the trend and likely predict a recession.