Index fund

Index funds Meaning

Index funds are passive funds that pool investments in selected securities. It is a form of mutual fund that tracks a broader market index such as the SandP 500. The investment is diversified across various stocks from different sectors of the economy. A market index provides a comprehensive view of the performance of a market segment and thus serves as a benchmark within the stock market. Therefore, a fund that tracks the market index is affected by the ups and downs of the overall market rather than any particular company.

Key points to remember

An index fund is a financial instrument with a portfolio that copies the quotation of a market index composed of different stocks and bonds belonging to several segments and sectors.

This investment product clones the risk and returns of the underlying index by providing an average return across all securities in the index.

These funds are passively managed investment vehicles.

These funds produce superior returns in 7 years or more and perform even better in efficient markets where most sectors perform exceptionally well.

Explanation of index funds

The index fund holds all securities that are also listed on a financial market index. Although these investments do not have to invest in all the assets of the index, the investment manager chooses some of the stocks listed. Since the fund is invested in many stocks and bonds from various sectors and industries, investors benefit from exposure to the broader market.

One of the particularities of such a fund is that it is a passively managed asset. The fund manager finds an appropriate market index and prepares an investment portfolio consisting of stocks listed in the index. Unlike actively managed funds, the role of the fund manager is limited. For active funds, managers must constantly reflect and modify the fund’s portfolio. Among the most popular are the Invesco SandP 500 High Dividend Low Volatility ETF which offers a dividend of 4.89% and the iShares Core High Dividend ETF which pays 4.07% of the dividend.

These funds are very different from common stocks,

exchange-traded funds (ETFs) and mutual funds. An index fund tracks the portfolio of its benchmark index, which is a classic combination of stocks. Along with other funds, individual stocks represent a profit and a loss for the individual company. A listed index fund replicates the stock market portfolio. In comparison, mutual funds are actively managed assets that contain a variety of carefully selected stocks. It is important to emphasize that index funds have a disciplined approach.

Holds all or a selection of shares in an index

the fund can precisely replicate its benchmark index by allocating funds to all listed assets or by choosing some of them in the group.

Lower cost

the fund is passively managed with few transactions. This leads to a significant drop in the expense ratios of index funds. Conversely, mutual funds constantly produce variable portfolios.

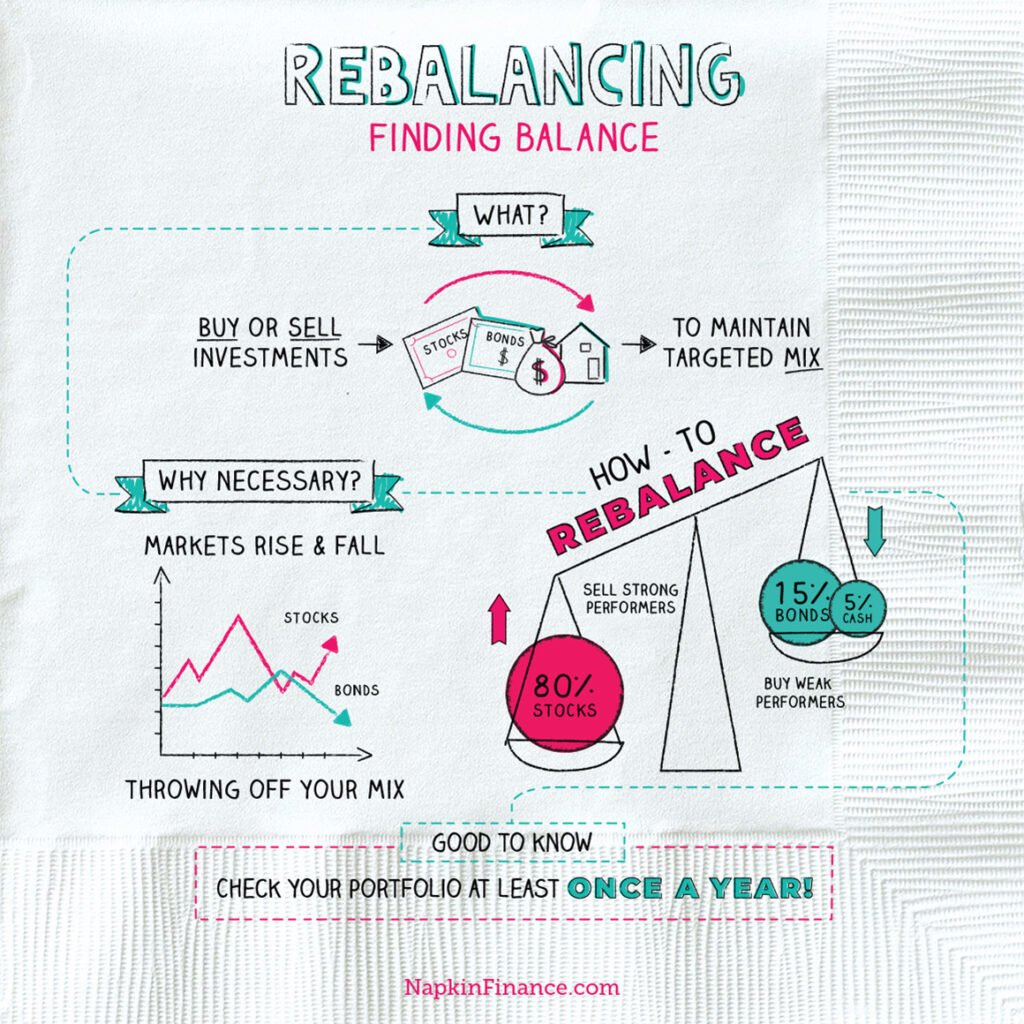

Automatic Rebalancing

This type of investment tracks and follows a country’s index. This includes; the best winners. This method automatically cleans the wallet by deleting inferior results. That too, without any intervention from the fund managers.

Diversification

There is no specific risk associated with these investments as they track a generic market index. It covers various sectors of the economy. Therefore, if a sector or a sector finds itself in difficulty, it will not affect the performance of the fund much.

Average Return

The portfolio returns of these investments often match the average return of the stocks held by an index. The Fidelity ZERO Large Cap Index Fund and the Schwab SandP 500 Index Fund are promising products for 2021. Their total returns in 2020 were 20.05% and 18%, respectively.

Suitable for efficient markets

It is often considered that as markets become more efficient, these funds can generate a higher margin. Market efficiency refers to stock prices incorporating all information quickly and efficiently.

Passive management

The investment manager simply seeks to buy and hold securities that would represent the index and continue to match its performance. Since the role of a fund manager is limited, the risk of error from ineffective portfolio selection is minimal.

Advantages

Funds invest in high-potential sectors and include a variety of different stocks. The risk is therefore diversified. An index has the property of self-balancing. Poorly performing assets are eliminated and the money is allocated to stocks at the top of the list.

Long-term, these funds provide benefits for at least seven years of ownership. They are growing with the development of the global market. Moreover, inefficient markets, these funds produce higher returns. This is the average of all stocks listed in the respective index. Due to the low expense ratio, investors save on

portfolio management fees. Costs are reduced as these funds do not require active professional management. They track the performance of the underlying index.

These assets are easy to manage. They require minimal effort from fund managers. By comparison, active fund strategy and management are hard work. It also reduces the burden on passive fund managers. I’m not under constant pressure to generate more clues.

Disadvantages

Index funds are subject to the risk of market corrections. As the fund’s portfolio is directly tied to the market movement or economy, it sees a sharp decline during an economic downturn or depression. Moreover, since these assets are not actively managed by professionals, their profitability is limited to the performance of the underlying index. As a result, this fund often has tracking errors. A tracking error is a mismatch between the returns of the fund and the returns of the underlying index.

These financial instruments often have the opportunity cost of

not investing in active funds. Additionally, investors are unable to obtain additional returns from growth stocks. These investment products are not widely promoted because brokers and agents earn low margins or commissions on the sale of these funds.

These portfolios are rigid and do not incorporate any changes proposed by the fund managers, which makes them a rigid product.