correction in market

In investing, a correction is a decline of 10% or more in a stock's price from its most recent peak. Corrections can occur on individual assets, such as a single stock or bond, or on an index that measures a group of assets.

An asset, index or market can be corrected for a short period or for long periods: days, weeks, months or even longer. However, the average market correction is short-lived and lasts three to four months.

Investors, traders, and analysts use charting methods to predict and track corrections. Many factors can trigger a correction. Whether it's a large-scale macroeconomic shift or problems in a single company's management plan, the reasons for a correction are as varied as the stocks, indices, or markets they affect.

How a patch works

Patches are like that spider under your bed. You know it’s there, hiding, but you don’t know when it will make its next appearance. Even if you lose sleep over this spider, you shouldn’t lose sleep over the possibility of a solution.

According to a 2018 report from CNBC and Goldman Sachs, the SandP 500’s average correction only lasted four months and values fell about 13 before recovering.1 However, it’s easy to see why the investor individual or inexperienced might worry about it. • a downward adjustment of 10% or more in the value of the assets in your portfolio during a correction. They didn’t plan for it and don’t know how long the correction will last. For most investors, in the long-term market, a correction is just a small hole in the road to retirement savings. The market will eventually recover, so they shouldn’t panic.

Of course, a dramatic correction that occurs during a trading session can be disastrous for a short-term or daily trader and highly leveraged traders. These traders could suffer significant losses during periods of correction.

No one can tell when a correction will start, or stop or say how long a price decline will take until it is over. What analysts and investors can do is look at past correction data and plan accordingly.

How a patch works

- A correction is a fall of 10% or more in the price of a security, an asset or a financial market.

- Corrections can last from a few days to several months, or even longer.

- Although detrimental in the short term, a correction can be positive, adjusting the prices of overvalued assets and providing buying opportunities.

Charting a Correction

Corrections can sometimes be projected using market analysis, and by comparing one market index to another. Using this method an analyst may discover that an underperforming index may be followed closely by a similar index that is also underperforming. A steady trend of these similarities may be a sign that a market correction is imminent.

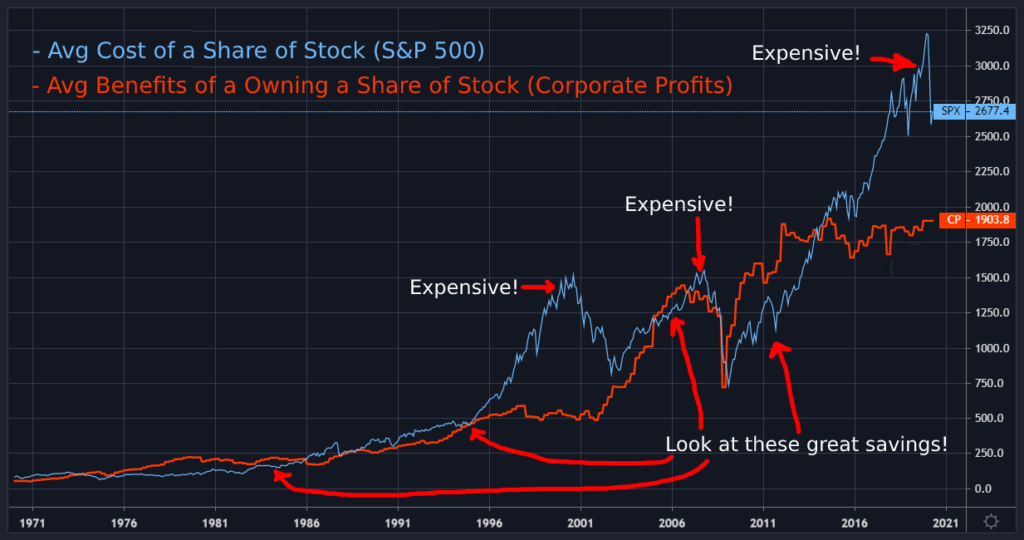

Technical analysts review price support and resistance levels to help predict when a reversal or consolidation may turn into a correction. Technical corrections happen when an asset or the entire market gets overinflated. Analysts use charting to track the changes over time in an asset, index, or market. Some of the tools they use to determine where to expect price support and resistance levels include Bollinger Bands, Envelope Channels, and Trendlines.

Preparing investments for a correction

Before a market correction, individual stocks may be strong or even outperform. During a period of correction, individual assets often perform poorly due to unfavorable market conditions. Corrections can create the perfect time to buy high-value assets at discounted prices. However, investors still need to weigh the risks associated with buying as they could very well see a further decline as the correction continues.

Protecting patch investments can be difficult, but doable. To deal with falling stock prices, investors can set up a stop loss or stop limit orders. The first is activated automatically when a price reaches a level set by the investor. However, the trade may not be executed at this price level if prices fall rapidly.

The second arrest order defines both a specified target price and an external limited price for trade .stoploss guarantees the execution in which Stop limit guarantees the price. Other sectors are more buffered. Consumer staples stocks, for example, tend to be business cycle proof, as they involve the production or retailing of necessities. So if a correction is caused by, or deepens into, an economic downturn, these stocks still perform.

Diversification also offers protection if it involves assets that perform in opposition to those being corrected, or those that are influenced by different factors. Bonds and income vehicles have traditionally been a counterweight to equities, for example. Real or tangible assets, like commodities or real estate, are another option for financial assets like stocks.

Although market corrections can be challenging, and a 10% drop may significantly hurt many investment portfolios, corrections are sometimes considered positive for both the market and investors. For the market, corrections can help readjust and recalibrate the assessments of goods that could have become systematically high.