Active Trading Strategies

Active trading strategies

Active trading is the act of buying and selling stocks based on short-term movements to profit from price movements on a short-term stock chart. The mindset associated with an active trading strategy differs from the long-term buy-and-hold strategy found in passive or index investors. Active traders believe that short-term moves and capturing the market trend are where the profits are made.

There are different methods used to build an active trading strategy, each with appropriate market environments and risks inherent in the strategy. Here are four of the most common active trading strategies and the internal costs of each strategy.

MAIN TAKEAWAY

- Active trading is a strategy of “beating the market” by identifying and timing profitable trades, often for short holding periods.

- Within the framework of active trading, several general strategies can be

- Day trading, position trading, swing trading and scalping are four popular active trading methodologies.

Day Trading

Day trading is perhaps the most well-known style of active trading. It is often considered a pseudonym for active trading itself. Day trading, as the name suggests, is the method of buying and selling stocks on the same day. Positions are closed the same day they are hired and no positions are held overnight. Traditionally, day trading is carried out by professional traders, such as specialists or market makers. However, electronic trading has opened up this practice to novice traders.

Position Trading

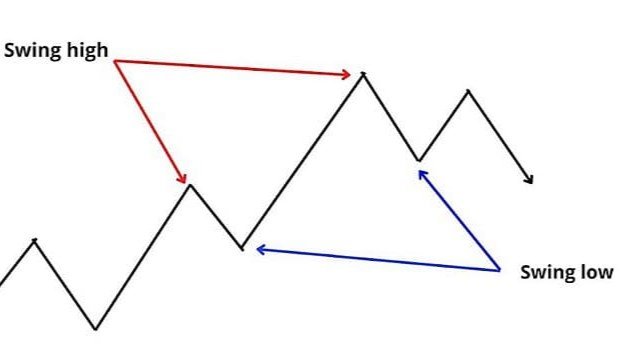

Some people view position trading as a buy-and-hold strategy, not active trading. However, position trading, when performed by an advanced trader, can be a form of active trading. Position trading uses long-term charts – from daily to monthly, in combination with other methods to determine the trend of the current direction of the market. This type of trading can last from several days to several weeks and sometimes longer, depending on the trend. Trend traders look for successive highs or lower highs to determine the trend of a stock. By jumping and riding the “wave”, trend traders aim to profit from both the ups and downs of market movements. Trend traders try to determine the direction of the market but do not try to predict a price point. Typically, trend traders jump on the trend once it has been established and when the trend stops they usually exit the position. This means that in times of high market volatility, trend trading is more difficult and its positions are usually small.

Swing Trading

When a trend breaks, swing traders usually kick in. At the end of a trend, there is usually some price volatility as the new trend tries to establish itself. Swing traders buy or sell when price volatility sets in. Swing trades are usually held for more than a day, but for a shorter duration than trend trades. Swing traders often create a set of trading rules based on technical or fundamental analysis.

These trading rules or algorithms are designed to identify when to buy and when to sell a security. While a swing trading algorithm does not need to be exact and predict the peak or valley of a price movement, it does need a market to move one way or the other. A limited or sideways market is a risk for swing traders.

Scalping

Scalping is one of the fastest strategies employed by active traders. Essentially, this involves identifying and exploiting bid-ask spreads that are slightly wider or narrower than normal due to temporary imbalances between supply and demand.

A scalper does not attempt to exploit large moves or trade at high volumes. Rather, they seek to capitalize on small movements that occur frequently, with measured transaction volumes. Because the level of profit per trade is low, scalpers look for relatively liquid markets to increase the frequency of their trades. Unlike swing traders, scalpers prefer calm markets that are not prone to sudden price movements.

Cost of Trading Strategies

There is a reason why active trading strategies were once only used by professional traders. Having an in-house brokerage firm not only reduces the costs associated with high-frequency trading but also ensures better execution of trades.12 Lower fees and better execution are two things that improve profit potential. strategies.

Significant purchases of hardware and software are typically required to successfully implement these strategies. In addition to real-time market data, these costs make active trading somewhat prohibitive for the individual trader, although not entirely inaccessible.

This is why passive and indexed strategies take a long position. costs, as well as lower taxable events when selling a profitable position. However, passive strategies cannot beat the market because they hold the general market index. Active traders seek “the alpha” in the hope that the benefits of trading will outweigh the costs and be a successful long-term strategy.

The Bottom Line

Active traders may employ one or more of the above strategies. However, before deciding whether or not to undertake these strategies, the risks and costs associated with each should be considered.