Understanding a Straddle Strategy for Market Profits

In trading, many sophisticated strategies are designed to help traders succeed whether the market is rising or falling. Some of the more sophisticated strategies, such as iron condors and iron butterflies, are legendary in the options world. They require complex buying and selling of several options at different strike prices. The result is to ensure that a trader can make profits regardless of the underlying price of the stock, currency or commodity.

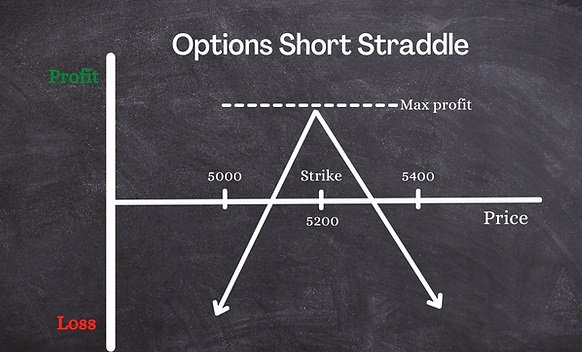

However, one of the less sophisticated options strategies can achieve the same goal of market neutrality with far fewer problems. The strategy is known as a straddle. It only requires the purchase or sale of a put and a call to be activated. This article will look at the types of overlaps and the pros and cons of each.